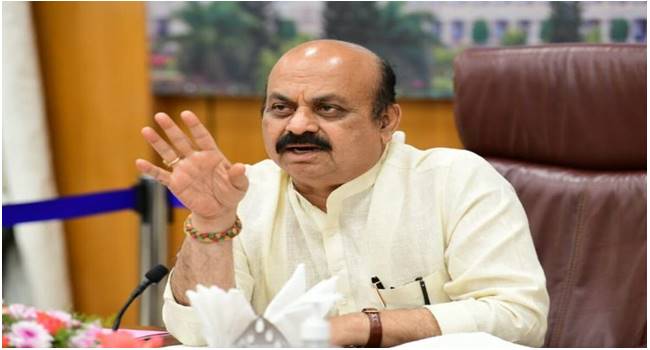

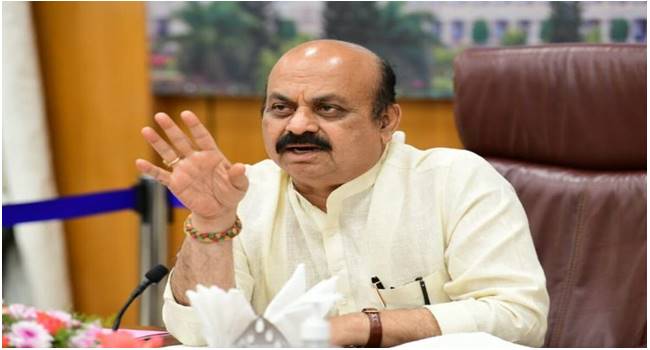

Pragativahini News, Bengaluru, Feb.17: Thanks to the restoration of the State Finances, Chief Minister Basavaraj Bommai said he presented a revenue surplus budget in compliance with the Fiscal Responsibility Act and a revenue surplus of Rs 402 crore is estimated for 2023-24.

Addressing a news conference here on Friday after presenting the state budget for 2023-24, he said due to the Covid-19 pandemic, the state finances were badly affected resulting in non-compliance with the Fiscal Responsibility norms in the past few years. The economic experts had predicted that it will take five years for the revenue surplus budget but it had been achieved within two years. A revenue surplus of Rs 402 crore is estimated for 2023-24 compared to a revenue deficit estimate of Rs 14,699 crore in the 2022-23 budget. Karnataka has been in the league of states with a high revenue surplus. The fiscal deficit of the state is estimated at 2.6 percent of the GSDP for 2023-24, which is well within the limit of 3 percent prescribed under the KFR Act, Compared to a fiscal deficit of 2.82 percent in BE 2022-23, attempts have been made to reduce the fiscal deficit for next financial year. “We have budgeted a total borrowing of Rs 77,750 crore for 2023-24 which would be used exclusively to fund capital expenditure in the state. Last year we had planned to borrow Rs 72,000 crore but the actual borrowing was less. In 2021-22, the borrowing was Rs 69,000 crore as against the proposed borrowing of Rs 71000 crore. Impetus has been given to increase revenue and less borrowing. Our state is second in GST collection. The State’s growth rate is 7.8 percent as against 6.8 percent of the Government of India”.

Best performance in three sectors

Bommai said the state has posted a robust development in three sectors, primary, second, and tertiary. Karnataka has been able to make a good performance in the agriculture, manufacturing, and service sector thanks to strict governance. Implementation of schemes was possible only when the funds are available and last year, the government issued orders for over 90 percent of the schemes announced in the budget, and the implementation of several schemes has started and others are in the pipeline. For the first time, the capital and revenue expenditure has been 76 percent till January and no government in the past had achieved that number. This means, projects are being implemented.

Action Taken Report

As said in the previous budget, the CM said an additional Rs 2,04,587 crore had been spent. The capital expenditure has increased as well as the implementation of schemes. An Action Taken Report is being supported on the status of implementation of projects including costing. It is wrong that the schemes that were announced in budget 2022-23 have not been implemented. Details will be given project-wise and department-wise.

He said the buoyant revenue in FY 2022-23 enabled him to propose a bugger budget for FY 2023-24 with the budget size crossing Rs 3 lakh crore for the first time in the history of Karnataka. The total consolidated fund (budget) size has increased from Rs 2,65,720 crore in 2022-23 and Rs 3,09,182 crore in 2023-23 budget estimates. This is an increase of Rs 43,462 crore with a growth rate of 16 percent. In the next one and a half months, the entire expenditure will be made.

In this budget, the total allocation under SCSP/TSP will be Rs 30,215 crore. In Budget 2022-23 the total allocation was Rs 28,234 crore which is an increase of Rs 1,981 crore. The total allocation for 2023-24 under SCSP/TSP is 24.53 percent of the allocable budget which is more than the 24.1 percent prescribed by the SCSP/TSP Act.

Also Read: CM Bommai promises special grants for Areca Research Center in Budget